Kakao, one of the most significant conglomerate corporations in Korea, recently announced its strategic decision to sell the majority of its subsidiaries, except its core assets. The decision comes in light of the increased “judicial risk” as founder Kim Beom Soo, the Chairman of Kakao’s Management Reform Committee, is under investigation by the prosecution on charges of stock price manipulation. According to the latest reports, the prosecution has also requested an arrest warrant for Kim.

A report by DongA Ilbo, dated July 17, KST, states that Kakao has decided to sell its subsidiaries, including Kakao Games, Kakao Entertainment, SM Entertainment, and Kakao VX. The Information Technology and Investment Banking industry reported on this development, stating that Kakao began looking for a buyer on July 15. The corporation, however, will retain its key assets, such as Kakao Bank, an online banking service, and Kakao Piccoma, a Japanese webtoon platform.

The report also mentioned that Kakao VX, a golf brokerage platform, has been in the process of being sold since the beginning of this year. Kakao Games will reportedly be sold after Kakao VX. Meanwhile, SM Entertainment and Kakao Entertainment, the two companies that have increased Chairman Kim’s judicial risk, will be sold after the investigation against him is completed.

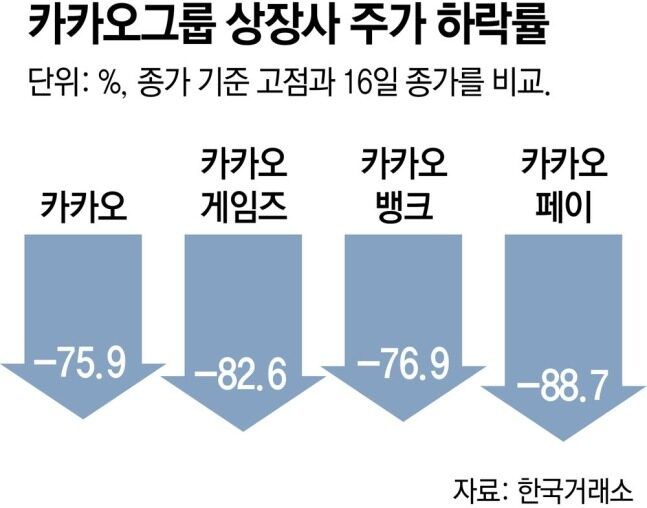

Meanwhile, last year Kakao was suspected of stock price manipulation during the acquisition of SM Entertainment. Kakao Mobility was also accused of violating accounting standards, adding to the industry-wide scrutiny and negative public opinion. Despite Chairman Kim’s best efforts, the stock prices of Kakao continue to plummet.