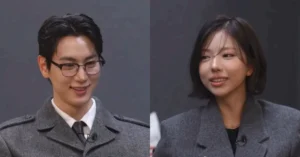

Actor Lee Joon Gi‘s agency, Namoo Actors, has officially addressed the recent reports concerning a tax audit involving the star. The agency released a statement to clear up any misunderstandings and provide accurate information regarding the matter. This announcement follows news that Lee Joon Gi underwent a tax audit, which led to a significant adjustment in his tax obligations.

According to Namoo Actors, the Gangnam Tax Office conducted a standard tax audit on Lee Joon Gi in 2023. This audit was part of the routine financial examinations carried out by the National Tax Service. Following the review, tax authorities concluded that additional taxes were due because of differing opinions on how Lee Joon Gi‘s income was categorized.

Consequently, Joon Gi was required to pay an extra 900 million KRW, which is approximately 617,000 USD. The agency emphasized that this tax adjustment wasn’t due to any intention of tax evasion or misconduct. Instead, it arose from a difference in how his financial team and the tax authorities interpreted and applied tax regulations. Namoo Actors also assured the public that Lee Joon Gi has fully cooperated with the reassessment order and has already paid the entire amount requested.

Details of Lee Joon Gi’s Financial Management

The tax audit primarily focused on JG Entertainment, a one-person agency that Lee Joon Gi established in 2014 with his father. This agency was set up to manage his professional earnings. While Lee Joon Gi has an exclusive management contract with Namoo Actors for his entertainment activities, his income was processed through JG Entertainment. This arrangement allowed his earnings to be taxed at the corporate tax rate of 24%, which is lower than the personal income tax rate of 45%.

Authorities reportedly questioned whether this structure was intentionally created to lower his tax responsibilities, leading to a detailed examination of his financial dealings and tax filings.

Property Concerns Addressed

Beyond the classification of income, the tax audit also scrutinized a luxury property located in Cheongna, Incheon. JG Entertainment purchased this property in 2021 for 2.95 billion KRW (approximately 2.02 million USD). Some reports speculated that the penthouse was being used as Lee Joon Gi‘s private residence rather than for legitimate business purposes. However, his representatives firmly denied these claims, stating that the property was acquired through proper legal channels.

After a comprehensive review, tax authorities confirmed that there were no irregularities in the property transaction, dismissing any doubts about its ownership and usage.

Agency Highlights Past Compliance and Appeal

Namoo Actors further explained that Lee Joon Gi‘s financial management system had not been considered problematic in previous tax audits. They also pointed out that there is currently no legal rule preventing an entertainer from managing their income through a personal corporation. Despite fully complying with the tax reassessment, Lee Joon Gi has filed an appeal with the Tax Tribunal, requesting a formal review of the decision. The agency stated that this request is currently under review, and the actor is awaiting an official response from the authorities.

To know the latest NEWS about Lee Joon Gi, Keep an eye on VvipTimes, and allow notifications from us to get instant updates on your device.

Credits- Chosun Ilbo