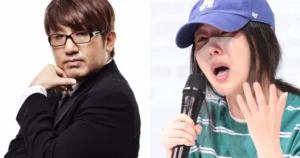

HYBE has hit back at ADOR CEO Min Hee Jin‘s claims she’s trapped in a “Slave Contract.”

During the recent press conference, Min Hee Jin made huge claims about her contract with HYBE, stating that it was a “slave contract” where she was bound to the company.

In response to the claims, HYBE hit back at the serious allegations made by Min Hee Jin and they explained that the “Non-compete” clause in the agreement was done to prevent unfair competition and are normal within any industry.

“Although there is an obligation in the agreement to keep the non-competition clause confidential, CEO Min mentioned it at the press conference. This clause is required to prevent unfair competition by the seller selling shares and founding a similar business in the same industry. These clauses are common in any industry.”

— HYBE

They then went on to refer to the claims that she is bound to HYBE “forever,” explaining the clauses within her contract and dates.

“The statement that they are bound indefinitely are also untrue. CEO Min can sell her shares starting in November, and if she sells, she will not be subject to ban on competition from November 2026, when her contract expires.”

— HYBE

HYBE emphasized that the conditions of Min Hee Jin’s contract were far from a “slave contract,” sharing some of the points that contradict the initial claims by the ADOR CEO.

“The conditions, which even allow cashing out and starting a new venture in two years, are far from what could be considered a “slave contract,” as Representative Min herself expressed confidence in earning a significant amount, stating that she could make 100 billion KRW without doing anything. These are unprecedented and generous compensation terms that ordinary individuals could hardly imagine.”

— HYBE

HYBE then spoke about a further conversation with Min Hee Jin about her “stock options.” In messages between Min Hee Jin and her associates, it seemed as if the clauses related to the contract saw a difference in priorities and how Min Hee Jin’s initial claims about “interest” in money seemed to change,

“Furthermore, in KakaoTalk conversations between Min and her associates, there’s a mention of exercising stock options to exit on January 2, 2025.

Regarding the interpretation of the clauses related to the sale in the contract, there was a difference in the priority of the two clauses, and the response sent in December last year already stated, “If the interpretation is ambiguous, resolve the ambiguous clause so that it does not become a problem.” While Min claimed to have no interest in money, the central issue that triggered the discussion was the scale of compensation.”

— HYBE