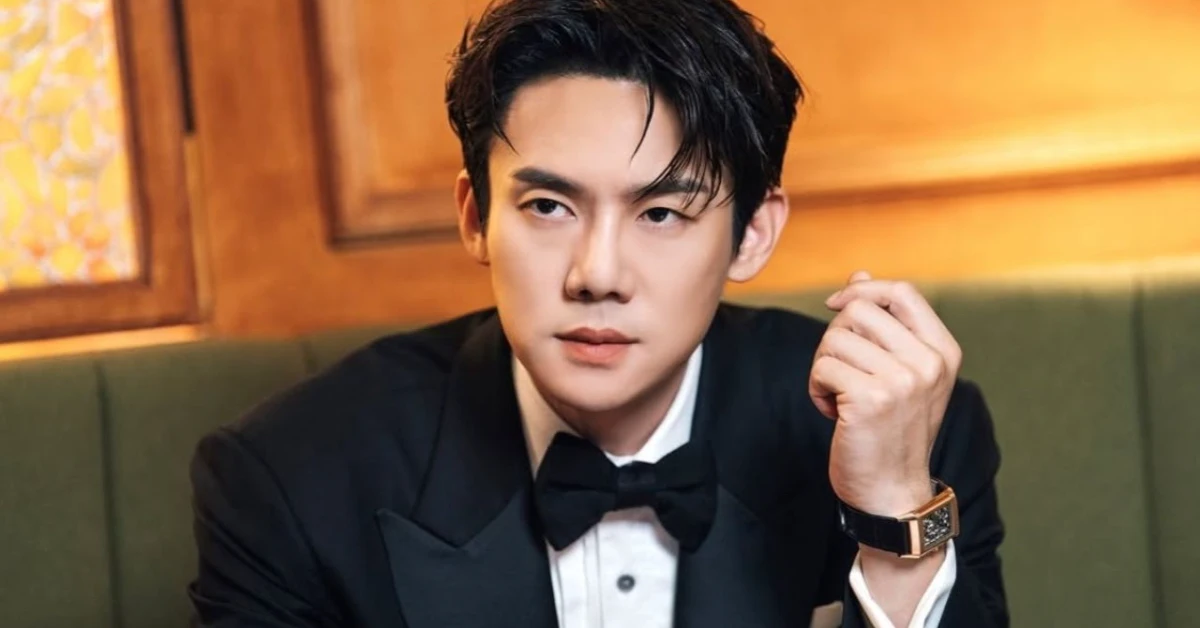

Actor Yoo Yeon Seok has successfully appealed a tax penalty, reducing the amount from 7 billion KRW (approximately $4.8 million USD) to 3 billion KRW (approximately $2 million USD). His agency, KingKong by Starship, confirmed that all due taxes have been paid in full.

Initial Tax Assessment

In March 2025, the National Tax Service (NTS) conducted an intensive audit of Yoo Yeon Seok’s finances. This audit led to a tax penalty of 7 billion KRW, reportedly the largest ever imposed on a South Korean celebrity. The assessment was linked to the activities of his agency, Forever Entertainment, established to manage his YouTube content and other ventures.

Agency’s Response

Yoo Yeon Seok’s agency responded promptly, clarifying that the issue arose from differing interpretations of tax laws between their tax representatives and the NTS. They emphasized that the matter was under review and not yet finalized.

Reevaluation and Reduction

After filing for a pre-assessment review in January, Yoo Yeon Seok’s legal team successfully demonstrated that the initial assessment involved double taxation. The NTS acknowledged this, leading to a reduction of the tax penalty to 3 billion KRW.

Payment and Compliance

Following the reevaluation, Yoo Yeon Seok promptly paid the revised amount in full. His agency reiterated his commitment to fulfilling tax obligations and adhering to relevant laws and procedures.

Context of Celebrity Tax Audits

This case highlights the increasing scrutiny of celebrities’ financial activities by South Korean tax authorities. Similar cases have involved other high-profile figures, such as actress Lee Ha Nee, who faced a 6 billion KRW tax penalty. These incidents underscore the complexities and challenges in interpreting tax laws within the entertainment industry.

Also Read: Yoo Yeon Seok’s Tax Allegations Spark Calls for K-Drama Role Change

For more updates on Yoo Yeon Seok, tune in to Vviptimes.

SOURCE: King Kong by Starship