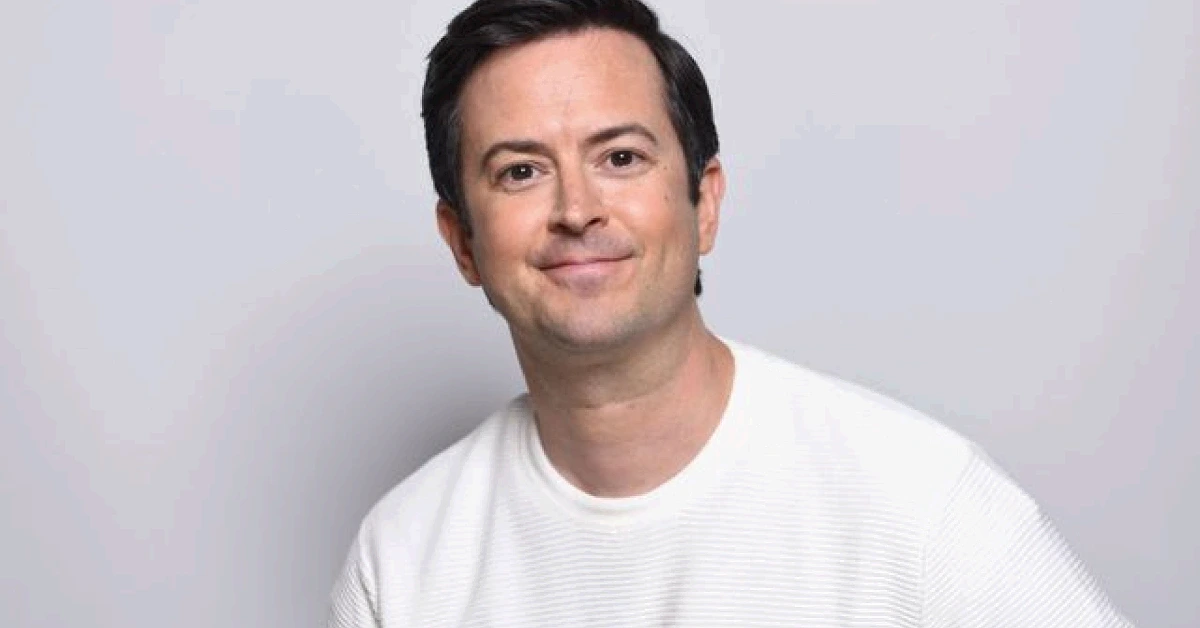

K-pop fans around the world are expressing shock and disbelief following new reports from investigative media outlet Dispatch concerning actor and ASTRO member Cha Eunwoo. The star is facing serious allegations from South Korea’s National Tax Service, which is pursuing a tax claim of roughly 20 billion won (about $13.6 million USD). This development, reported on January 24, 2026, has sparked intense online reactions, with many supporters stating they never saw this type of controversy coming for the beloved idol.

The investigation centers on a company established and operated by Cha Eunwoo’s family. Authorities allege this entity was used to divert a portion of his earnings to take advantage of lower corporate tax rates, avoiding the higher personal income tax that can reach up to 45%. Cha Eunwoo’s agency, Fantagio, is also involved, having been ordered to pay an additional 8.2 billion won in taxes for its role in the arrangement. Both Cha Eunwoo’s representatives and Fantagio have stated they will appeal the decision, arguing the company was legally established to manage his career. Cha Eunwoo is currently serving in the military and is expected to be discharged in January 2027.

Core Allegations: A Family-Run Company Under Scrutiny

According to the detailed report from Dispatch, the controversy involves a series of companies established by Cha Eunwoo’s mother, identified as Mrs. Choi. The initial company, Cha’s Gallery, was set up in July 2019, with Cha Eunwoo as CEO and his parents listed as internal director and financial manager. This company underwent several relocations and rebranding, eventually becoming the limited liability company The Annie in 2024.

The National Tax Service’s investigation determined this family-run company was a “paper company,” meaning it existed primarily on paper without providing real, separate services from Fantagio. Tax authorities found its registered address on Ganghwa Island was unsuitable for an entertainment business and, despite processing expenses and owning imported cars, it did not perform distinct managerial work. The financial benefits from this setup allegedly flowed back to Cha Eunwoo, resulting in the massive unpaid income tax bill.

Fantagio shared a statement saying, “This matter has not yet been finally determined or notified, and it plans to actively explain the position through lawful procedures with regard to issues of legal interpretation and application.”

Fan Reactions: From Disbelief to Defensive Support

The news has dominated online fan communities and social media, with the phrase “Cha Eunwoo’s downfall was not on my bingo card” trending. This expression captures the widespread surprise among fans who never anticipated such serious allegations against the star known for his clean-cut image.

Reactions are deeply divided. A significant portion of the fanbase is grappling with disappointment and confusion. “He was army MC last year and this year a tax evader?” one fan questioned on a social media post summarizing the Dispatch report, highlighting the stark contrast in public perception. Many are adopting a “wait-and-see” approach, urging others not to rush to judgment before all legal appeals are exhausted. “Keep hearing what dispatch have to say and not the government,” another comment read, suggesting skepticism about media reporting.

Concurrently, a strong contingent of supporters remains fiercely defensive. They argue the family’s actions were meant to protect Cha Eunwoo’s career, especially during periods of instability at his main agency, Fantagio. “Do people really think Nunu’s family would try to ruin his name with shameful acts? They’d be the first to defend him and take steps to protect him,” a supporter posted online. This group maintains that the company was a legitimate business venture for career management, not a scheme for tax avoidance.

Connection to Family Eel Restaurant Adds Another Layer

Adding complexity to the story is the connection to a popular eel restaurant on Ganghwa Island. In late 2022, this restaurant was featured on a JTBC variety show as “Cha Eun Woo’s favorite restaurant”. Cha Eunwoo had previously posted about visiting it on Instagram and mentioned receiving eel from his father’s hometown.

It was later revealed that this same restaurant is operated by his parents and was used as the registered business address for the family company, The Annie, in October 2022. This has led to separate accusations of “hidden advertising,” with netizens criticizing Cha Eunwoo for promoting his parents’ business on national television without disclosing his familial connection.

“People would have gone even if he had openly said it was his parents’ restaurant,” one netizen commented, while others expressed confusion over why the connection was kept secret. This aspect has fueled further online debate about transparency and has become intertwined with the larger tax investigation in public discussion.

Also Read:

Legal Status and What Happens Next

As of now, the tax claim is not final. Cha Eunwoo’s legal team has filed a request for a review of improper taxation and will pursue an appeal. The star’s side argues the company was founded out of maternal concern during a turbulent time for Fantagio and was a legally sound vehicle for managing his activities.

The outcome of this appeal process within the National Tax Service will determine the next steps. If the ruling is upheld, further legal action in court is a possibility. Throughout this process, Cha Eunwoo remains in active military service, which adds a unique dimension to how the situation is being managed publicly and legally.

Also Read: High Potential Season 2 Episode 11 Release Date, Plot Details, Cast News and How to Watch