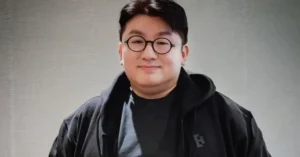

The Seoul police have requested a search and seizure warrant for HYBE Chairman Bang Si Hyuk over claims he misled investors before the company’s stock market debut. Authorities suspect he made over 100 billion KRW (~$72 million) in illegal profits by convincing shareholders to sell their stakes under false pretenses.

Fraud Allegations Linked to HYBE’s IPO

Bang Si Hyuk, the founder of HYBE (home to BTS), is under investigation for possible fraud related to the company’s initial public offering (IPO) in 2020. Police say he told early investors in 2019 that HYBE had no plans to go public, leading them to sell their shares at lower prices.

These shares were then bought by a private equity fund reportedly connected to HYBE executives. After HYBE went public, the fund sold the shares for massive profits, with Bang allegedly receiving over 100 billion KRW. The Financial Supervisory Service (FSS) found evidence that shareholders were misled, violating South Korea’s Capital Markets Act.

“They concluded that Bang’s fund manipulated trades to secure over 1 trillion KRW (approximately $720 million) in gains, with approximately 400 billion KRW (approximately $287.4 million) of that going directly to Bang. However, that money should have gone to the original shareholders.”

National Pension Service Involvement Raises Concerns

The scandal has grown bigger after reports revealed that South Korea’s National Pension Service (NPS) was among the investors affected. Critics argue that public retirement funds were used to benefit private individuals, raising questions about how the NPS manages money.

“If the alleged fraudulent actions had not taken place, the expected profit of around 1 trillion KRW (approximately $720 million) would have flowed back to the public through the pension fund.”

Financial experts say the NPS and other institutional investors may take legal action to recover losses. The Securities and Futures Commission has already filed a complaint against Bang with prosecutors.

Insider Trading Probe at HYBE

Separately, prosecutors recently raided HYBE’s headquarters in Seoul over an insider trading case involving an employee. The worker is accused of making 240 million KRW (~$173,000) by buying shares in YG Plus before HYBE’s investment in the company was publicly announced.

This isn’t the first time HYBE has faced such issues. In 2022, employees of a HYBE subsidiary were charged with insider trading after selling shares before BTS announced a hiatus, avoiding 200 million KRW in losses.

Possible Legal Consequences for Bang Si Hyuk

If found guilty, Bang could face severe penalties. Under South Korea’s Capital Markets Act, fraud involving over 5 billion KRW (~$3.6 million) can lead to a life sentence. Legal experts say the case is serious due to the large sums involved and the impact on public funds.

HYBE has responded to the allegations, stating:

“It is unfortunate that the explanation provided by our largest shareholder during the investigation was not accepted. He clearly stated that there was no intention to pursue personal gain related to the company’s listing. We respect the decision of the authorities and will do our best to resolve the allegations.”

Next Steps in the Investigation

The police have finished analyzing financial records from the Korea Exchange and Financial Supervisory Service. They are now waiting for prosecutors to approve the search warrant for HYBE’s offices and Bang’s property.

Meanwhile, on July 16, the Securities and Futures Commission (SFC) under the Financial Services Commission referred Bang Si Hyuk to the prosecution for violating the Capital Markets Act’s prohibition on unfair trading practices.

The case had been assigned to the Seoul Southern District Prosecutors’ Office, which specializes in financial crimes. But, the Seoul Southern District Prosecutors’ Office stated this afternoon that the case has been assigned to the Capital Markets Special Judicial Police under the Financial Supervisory Service for investigation.

About the police warrant request, the Seoul Metropolitan Police Agency also commented that it “will ensure the ongoing investigation into HYBE proceeds smoothly.”

Legal experts say the investigation could take months, given the complexity of stock market fraud cases.

Credits: KBS